Traders are anything but not a get-rich-quick people, although the opportunity to make a huge sum of money in a relatively short time span is what most newbies find appealing. This and the craze for new financial markets enabled by the Internet are the main reasonс for the appearance and popularization of burgeoning markets, such as Forex.

Much of the new blood among Forex traders comes from relatively inexperienced people with little or no background in economics. Most of these non-professional Forex traders have tried themselves in one or more free trading simulators, webinars aimed at teaching beginners some of the basics of Forex trading. However, no matter how accurate and realistic this simulations may be, they cannot fully prepare a non-professional Forex trader and replace years of experience of other traders; even if he/she gets a perfect score, shows promise or is extremely successful, the simulated profits and losses are quite different from the real ones. Those simulations can, however, lead some non-professional Forex traders to believe that the profession of a Forex trader is an easy one, with clear-cut situations or consequence-free options. These false assumptions usually come to an abrupt and financially brutal end when those virtual profits switch places with real losses because a non-professional Forex trader has made a series of bad and uninformed decisions. Forex markets can be unforgiving in such cases.

The first change that non-professional Forex traders feel after switching from the simulator to the real thing, is a psychological one. The realization that their actions have real consequences in real life can be intoxicating and/or sobering one, depending on the non-professional Forex trader’s type of character. It is usually the latter, at least in the end. As their hard-earned money is hanging in the balance, the pressure and how they handle it will quickly separate savvy Forex traders from amateurs.

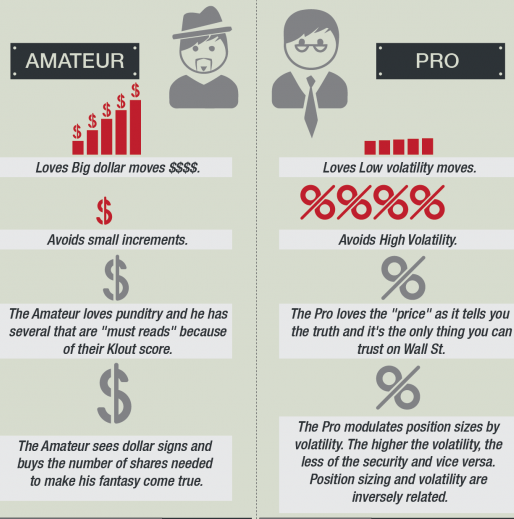

After fear comes greed, for those who even make it to that point. After all, some people just don’t know when to quit. Non-professional Forex traders prone to greed will find themselves on a rollercoaster leading them from huge profits to staggering losses to trying to salvage whatever has remained. The reason non-professional Forex traders fail is their inability to form a realistic plan and follow it through; whether the cause is fear, greed, anxiety, lack of experience or something else is ultimately irrelevant. But going to the other extreme is just as damaging. Non-professional Forex traders who focus on analyzing often back down before even initiating the trade, always searching for that perfect analysis encompassing every single factor.

The solution is self-evident. Forex markets require a balanced and intelligent approach as well as a dose of experience from their traders. No one is perfect, and emotions are hard to control, but acknowledging one’s flaws and difficulties is always the first step in overcoming them. Proper motivation and planning can and will help non-professional Forex traders graduate into hardcore financial experts.