Forex market has been interesting over the past week, with several important developments. After a summary of major forex currencies in the week behind us, we will go through some interesting news from around the world and conclude with the reminder for the following week.

Quick Recap of the Week

We’ll start with the EUR/USD pair. Previous forecasts were bullish on this pair and it would seem they have been right on the money. On Wednesday, the price reached 1.1365 which basically means the bullish forecast is still very much a go. In fact, the current estimates place the next target level at 1.1430/35, a number which was last reached immediately after Brexit became a thing, but keep in mind that the trend is getting close to a reversal and that point is going to be dangerously close to 1.1430/35.

The GBP/USD was supposed to make a quick comeback to 1.3170, and while this move was expected, its scope was anything but. The current recorded high stands at 1.3186 and it does not seem like it is going to let up any time soon. At this rate, it should come as no surprise if the British pound reaches 1.3270 next week. Although to be fair, it should be said that the chances are slim to none, so we would advise against such a move. From where it is, it will either drop below 1.3020 or the pair is going to stay underpinned for the week ahead.

The Australian dollar and the AUD/USD pair in particular have been doing relatively well, holding their range between 0.7595 and 0.7760, which is coincidentally what they are expected to do in the near future as well. Overall, while the chances are the range is going to hold, there is a slight possibility of the AUD reaching the 0.7595 mark first and if it does break range, it will probably do so in a downwards. Still, this is still a long shot.

The Kiwi has not seen any major developments, especially when it comes to the NZD/USD pair. They will most likely remain in the old 0.7170/0.7350 range, unless there are major unforeseeable events. Let’s hope there aren’t any.

Finally, the Japanese Yen has gained in strength but only slightly, so the bearish outlook is still considered realistic at this point. The UDS/JPY may even fall to 99.05/10. Still, the stop-loss is the same as before, firmly at 101.20 although some may wish to consider 100.70 in case of a sudden rebound.

Source: efxnews.com

Forex Forecast for Major Pairs

- EUR/USD: Bullish: Consider taking partial profit at 1.1430/35.

- GBP/USD: Neutral: There is a slight chance to reach 1.3270 but don’t hold your breath just yet.

- AUD/USD: Neutral: Will likely remain in the 0.7595/0.7760 range.

- NZD/USD: Neutral: Also predicted to remain within the 0.7170/0.7350 range.

- USD/JPY: Bearish: The prediction talks about the possibility of falling to 99.05/10.

Source: efxnews.com

Mongolian Economy in Trouble

Last Thursday, Mongolian government was forced to raise its benchmark interest rate by four and a half points which has officially placed the Mongolian tugrik as the worst performing currency in the world this August, at least. It is unlikely that another currency will catch up in the next few days until September. Now the country with 3 million residents and 70 million livestock will have to deal with the IMF and its bailout yet again, for the first time since 2009.

What spurred this crisis is the over-reliance on its own mineral reserves, which are some of the most easily accessible in the world. Still, by tying its economy to a single type of resource it may serve as a warning to the economies of Saudi Arabia, Brazil and Russia as to what they need to avoid.

Things being what they are, the drop in prices of iron, copper, oil and gold – which were to serve as a backbone of yet another Asian miracle – led to a cycle of over expenditure and mounting debts. Also, by propping their economy against Chinese, Mongolians have also tied their fates which may well come to haunt them as the time goes by.

Such as it is, Mongolian civil servants are looking at a pay cut that may reach as high as 60%, in addition to slashing public spending and halting many existing projects. The only way for their economy to recover is to either move away from Chinese economy or wait until it gets back on its feet.

Read more at Bloomberg.com

Brexit on Hold Till 2017

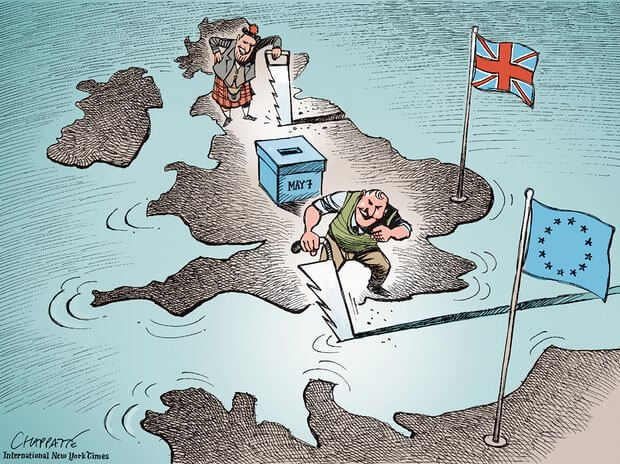

Also, an unidentified spokesperson for the Downing Street was cited by Reuters leaking the news that the new Prime Minister Theresa May is not going to start the talks with the EU until next year. According to what an anonymous source told Bloomberg, Mrs. May is “sympathetic” to the notion of starting the talks by next April.

Credits: Chappatte

So far, the Downing Street has yet to recognize this briefing and maintain that the Article 50 that decides on the divorce between the EU and the UK will be put into motion but not before the end of the year. So far, it remains to be seen just what kind of reaction this will cause on the forex market.

Read more at reuters.com

Forex Reminder: Upcoming Events for the period of

USD

Wed:

- 16:00 Existing Home Sales (MoM) (JUL)

- 16:30 Crude Oil Inventories (AUG 19)

Thu:

- 14:30 Durable Goods Orders (JUL P), Initial Jobless Claims (Aug 20) and Durable Ex Transportation (JUL P)

- 15:45 Markit US Services and Composite PMI (AUG P)

Fri:

- 14:30 Advance Goods Trade Balance (JUL), Gross Domestic Product (Annualized) (2Q S), USD Personal Consumption (2Q S), USD Gross Domestic Product Price Index (2Q S), USD Core Personal Consumption Expenditure (QoQ) (2Q S)

- 16:00 Fed Chair Yellen to Speak at Jackson Hole Policy Symposium and U. of Michigan Confidence

EUR

Tue:

- 09:00-10:00 A series of announcements concerning French, German and Eurozone Manufacturing, Services and Composite PMIs.

- 16:00 Consumer Confidence report

Wed:

- 08:00 German GDP w.d.a. and n.s.a.

Thu:

- 10:00 German IFO – Business Climate, Current Assessment and Expectations (AUG)

GBP

Wed:

- 10:30 BBA Loans for House Purchase (JUL)

Fri:

- 10:30 Gross Domestic Product (YoY and QoQ) (2Q P)

CHF

Tue:

- 08:00 Trade Balance (JUL)

Wed:

- 08:00 Consumption Indicator

Thu:

- 09:15 Industrial Production (YoY) (2Q)

AUD

Wed:

- 03:30 Construction work report for the second quarter of 2016.

NZD

Wed:

- 00:45 Trade balance report (JUL)

JPY

Tue:

- 04:00 Nikkei Japan PMI Mfg (AUG P)

- 06:00 Kuroda Speaks at BOJ’s Fintech Conference

Wed:

- Small Business Confidence report

Thu:

- 01:50 Japan Buying Foreign Bonds/Stocks (AUG 19)

Fri:

- 01:50 National Consumer Price Index (JUL)

Source: dailyfx.com

In simple terms, try to think of Forex exchange rates as the price of one currency, except it is in another currency – say, the price of Euros in U.S. currency in. The value of a single euro in U.S. dollars would be something like 1.13172. In other words, if the price of the EUR/USD pair is 1.13172 it means that is how many dollars you would get on a single Euro. Of course, bid and ask prices would also have to be factored in. But the point is, Forex exchange rates are what determines how much money you will make, or whether you will make any at all.

In simple terms, try to think of Forex exchange rates as the price of one currency, except it is in another currency – say, the price of Euros in U.S. currency in. The value of a single euro in U.S. dollars would be something like 1.13172. In other words, if the price of the EUR/USD pair is 1.13172 it means that is how many dollars you would get on a single Euro. Of course, bid and ask prices would also have to be factored in. But the point is, Forex exchange rates are what determines how much money you will make, or whether you will make any at all. Thanks to the effects of globalization, all of the markets in the world are interconnected, for better or worse. Whatever happens, anywhere in the world could potentially affect you and your bottom line, which is why Forex rates today are such a pain to deal with. You see, the value of a currency is far more complicated to be explained by a simple formula such as economy + supply/demand = value. Forex exchange rates do not work that way.

Thanks to the effects of globalization, all of the markets in the world are interconnected, for better or worse. Whatever happens, anywhere in the world could potentially affect you and your bottom line, which is why Forex rates today are such a pain to deal with. You see, the value of a currency is far more complicated to be explained by a simple formula such as economy + supply/demand = value. Forex exchange rates do not work that way. Currency swaps are the most obvious, if a bit crude, type of derivatives. Basically, the two parties exchange some currency on the spot and agree to switch back after a while. Usually there is some sort of collateral on the side. If used wisely, this strategy can ensure you can “safely” store your currency until a later date. Your loss is someone’s gain and vice versa, but that is how Forex currency exchange works, does it not?

Currency swaps are the most obvious, if a bit crude, type of derivatives. Basically, the two parties exchange some currency on the spot and agree to switch back after a while. Usually there is some sort of collateral on the side. If used wisely, this strategy can ensure you can “safely” store your currency until a later date. Your loss is someone’s gain and vice versa, but that is how Forex currency exchange works, does it not?

When employed properly, hedging strategies, Forex or otherwise, can result in anything from a deal going through with minimal losses to the deal falling through completely, but the trader still breaks even. If the Forex hedging is not done properly those losses could be huge. Still,

When employed properly, hedging strategies, Forex or otherwise, can result in anything from a deal going through with minimal losses to the deal falling through completely, but the trader still breaks even. If the Forex hedging is not done properly those losses could be huge. Still,  For instance, getting a currency option on the same pair could ensure there is a safe point, in case the spot market decides to throw a tantrum. If the spot price is more favorable, the option will expire worthless, but the income should easily offset the fee for the option. Otherwise, the trader will activate the option and recoup some of the losses, if not all. The problem with this strategy is getting your hands on the right option, as someone needs to be willing to share the risk. The fee may be too great in case the trader gets too greedy.

For instance, getting a currency option on the same pair could ensure there is a safe point, in case the spot market decides to throw a tantrum. If the spot price is more favorable, the option will expire worthless, but the income should easily offset the fee for the option. Otherwise, the trader will activate the option and recoup some of the losses, if not all. The problem with this strategy is getting your hands on the right option, as someone needs to be willing to share the risk. The fee may be too great in case the trader gets too greedy. First and foremost, in order to apply hedging strategies, they need to be able to assess the risks they are facing. As well as to figure out whether a risk is even worth hedging! If a trade is too costly to hedge and too risky to follow through unchecked, then the best course of action may well be to move along and wait for a better opportunity. Then again, if risk assessment is done poorly, that better opportunity may never come, as the trader will not be able to recognize it.

First and foremost, in order to apply hedging strategies, they need to be able to assess the risks they are facing. As well as to figure out whether a risk is even worth hedging! If a trade is too costly to hedge and too risky to follow through unchecked, then the best course of action may well be to move along and wait for a better opportunity. Then again, if risk assessment is done poorly, that better opportunity may never come, as the trader will not be able to recognize it.