Have you ever wondered how (your) emotions influence (your) trading? The trader’s emotional stability is just one aspect. In his interview with George Papazov

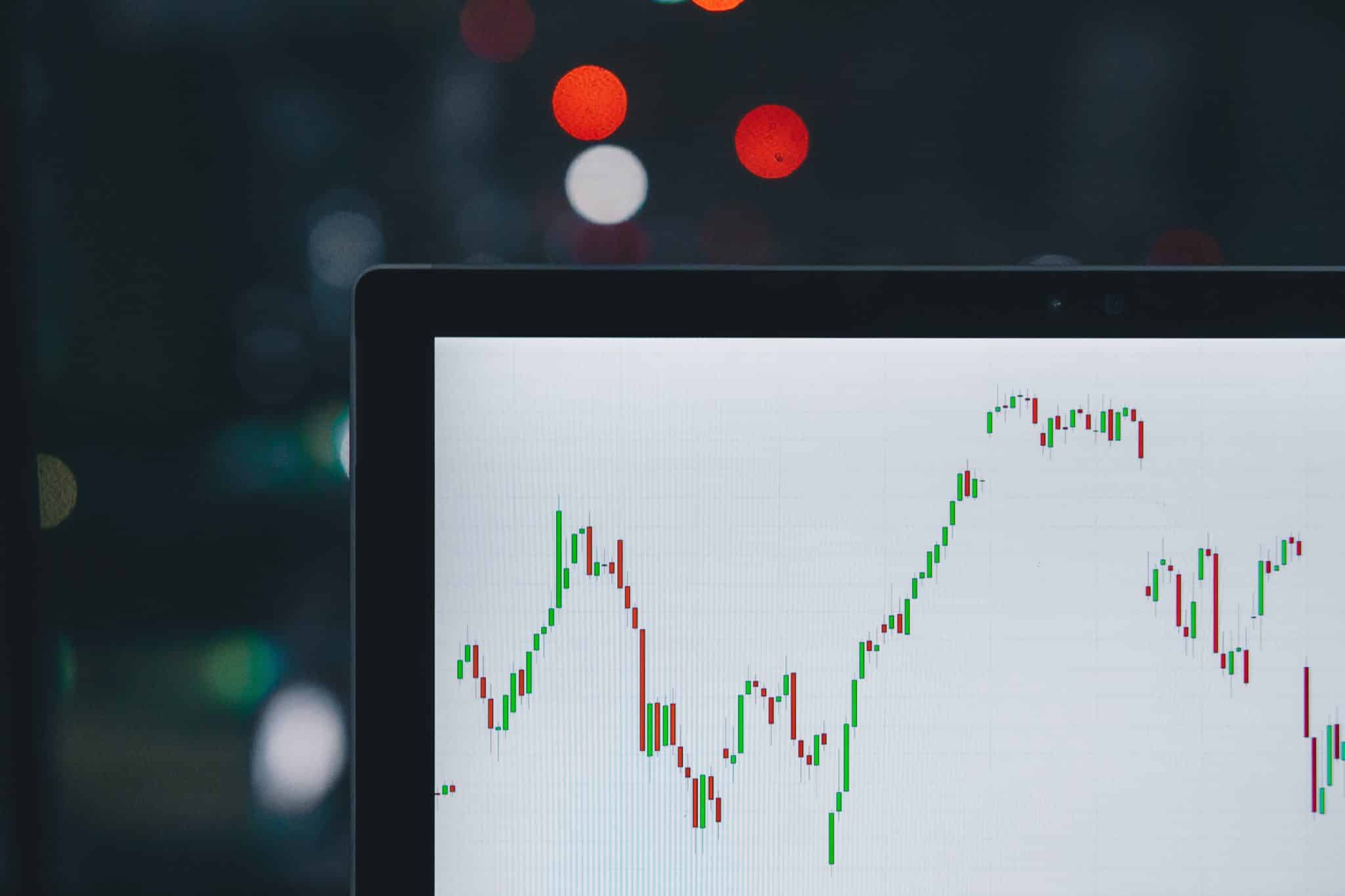

One of the most familiar ways for trading the financial market is to use the outback strategy. That really means to jump into the market which has been established as a trend and then goes against it. The concept is that you wait for the price to “pull back” during a movement for a better entry price. When the market is going higher, and you think that it will be exactly the same for a long time for the lowest price possible. This pullback trading will guide you to find such opportunities. A pullback is a moderate drop in commodities and stock for a pricing chart with recent peaks of continuing uptrend. A pullback is like a retracement or consolidation because of the same terms. The term pullback is usually applied to somewhat short pricing drops – for example, a few consecutive sessions – before the uptrend resumes.

KEY TAKEAWAYS

- A pullback is a temporary setback in the price action of an asset or security.

- The duration of a pullback is only a few successive sessions, and a longer delay before the uptrend resumes is generally referred to as an alliance.

- Pullbacks can offer an entry point for traders looking to join a position when other technical indicators remain bullish.

What Does a Pullback Tell You?

Pullbacks are seen as buying opportunities after a share has undergone a significant upward price movement. For example, a stock may substantially increase- following a favorable earnings announcement and then face a pullback as an investor with existing positions takes the profit off the table. Yet, the fair earnings are a primary signal that says the stock will restart its uptrend.

Most pullbacks affect a share’s price moving to a place of technical support, such as a moving average, before resuming their uptrend. Traders should observe these key support areas since a breakdown could signal a reversal rather than a pullback.

What Are The Famous Strategies Of Pullback Trading

Knowing how to trade pullbacks can be a great mastery as an investor. Pullbacks take place at every time, and if you know how to trade pullbacks. You can improve your stock and find many more high-probability trading scenarios. Pullbacks come in many different forms. Here we will explain the five most famous pullback trading strategies:

Pullback 1: Breakout pullback

This is one of the common types of strategies that every trader has experienced once in a lifetime. Breakout pullbacks generally take place when a market turns into price and breaks out of the consolidation pattern. The most popular consolidation patterns are wedges, Head and Shoulders, rectangles, or triangles.

Always take precautions that moving a stop loss to break even is hazardous and unprofitable. The reason behind this is that pullback breakout happens more oftenly. The price entry is triple top after an extended uptrend. The triple top has a defined lower support level. Many traders operate such levels to make their breakout entries. But where they face the problem is – When they move their stop loss to break even too soon. And when the breakout pullback happens, they will get kicked out of their trade. It is such a common pullback scenario that you will start noticing it all the time.

Pullback 2: Horizontal steps

You can observe this during many trending phases across all monetary markets. It is the natural price pattern and shows the flow of market conduct. During ongoing trending stages, the price will often present those stepping designs. This pullback approach is an excellent multiplication to the earlier explained breakout pullback. The breakout pullback occurs very near to market turning points. But if a trader skips the initial entry chance, the horizontal phases can allow the trader to find an alternative entry as the trade progresses. Furthermore, a trader could also use the stepping pattern to pull the stop loss behind the trend safer. In this circumstance, the trader waits until the price has completed a step and then pulls the stop-loss after the last pullback area. The stop loss is then covered and not as weak.

Pullback 3: Trendline

Trendlines are another well-known pullback tool. The flaw is that trendlines often take longer to be validated. You can always connect two random facts, but you look at a trendline only when you get the third. Therefore, the trendline pullback is traded at the third, fourth, or fifth contact point. Trendlines and other pullback methods can work well as a standalone, but the trader may miss many chances because the trendline validation takes a long time.

Pullback 4: Moving Average

Moving averages are among the most favorite tools in technical analysis, and they are used in many ways. And you can use them for pullback trading as well. You could use a 20, 50, or 100-period moving average. It doesn’t matter, and it comes down to whether you are a short-term or long-term trader. Shorter-term traders generally use shorter moving averages to get signals quicker. Of course, shorter moving averages are also more vulnerable to noise and wrong signals. On the other hand, Longer-term moving averages move slower, are less susceptible to noise, and may miss trading opportunities in the short term. You have to calculate the pros and cons of your trading.

Pullback 5: Fibonacci

Fibonacci pullbacks can be merged with moving averages very effectively. When a Fibonacci retracement drops into the same place with a moving average, those can be high probability pullback areas. As you have seen, there are different methods to approach pullbacks, and you can even merge the various tools to come up with even stronger signals. Which one is your favorite, and what are your experiences with pullbacks?

How Do You Buy A Pullback?

Pullbacks are seen as buying opportunities after security has experienced a significant upward price movement. Although there are many methods to approach pullback trading, we will discuss the two main concepts of pullback trading. These principles are applied to all other pullback scenarios in this essay.

The forceful trader waits for the price back to the pullback place and enters a trade straight away here. There are some points you need to think about when choosing such a course:

- You may enter for the most acceptable price as this point can often mark the end of the correction wave and the pullback step.

- The possible reward/risk ratio is highest practicing this approach because the stop loss is placed tightly.

- The disadvantage is that you enter a trade against the price direction, and the price could go fast against you much further.

- Such an approach, thus, can have a lower win rate. The higher/reward risk ratio may cancel it, though.

The conservative trader waits until the price drops. The conventional entry happens right when the price drops. With this approach, the trader goes with the momentum. The traditional access occurs later, and, therefore, the potential reward/risk ratio is also smaller.

There is no right or wrong. It comes down to the particular preferences of the trader. Notice that the price would have come back into the pullback area again in this example. It shows how common pullbacks are, because they highlight the natural price wave structure in any financial mark.

How To Use Pullback Strategy

Failing trades with pullback plays tend to arise for one of three reasons:

- You miscalculate the counter trend wave’s scope and join too early.

- You enter at the ideal price, but the counter trend keeps going, smashing the logical calculation that puts off your entry signals.

- The bounce gets underway but then aborts, crossing through the entry price because your risk management plan failed.

The last case is the easiest to manage. Place a trailing stop behind your position as soon as it moves in your favor and adjust it as the profit increases. The stop required when you first enter the place is directly related to the price desired for entry. As you earn experience, you will notice that many pullbacks reveal logical entries at several levels. The longer you wait and the more in-depth it goes without breaking the technical. It is easier to stop just a few ticks or cents behind a significant cross-verification level. You will miss perfect reversals with a deep entry strategy at intermediate levels, but it will also produce immense profits and the most negligible losses.

Give An Example Of How To Use A Pullback

The first step to pullback trading is recognizing a trend and then trading in its direction. If you’re trading in the daily routine, then you must have to trend on the daily time routine. For example, a business may report blow-out earnings and see stakes jump upto 20%, and the stake may face a pullback the next day as short-term traders seal in profits. However, the strong earnings report indicates that the stock’s business is doing something good. Buy and hold traders and investors will be attracted to the stock by the healthy earnings reports, supporting a sustained uptrend in the near term.

Joy wanted to enter in the trading, but he calculated the price share is high, and it may not go higher than this but could go down in price. So, Joy waited for the share price to go down and bought shares at the determined price. In a pullback strategy, traders don’t chase the price. They wait for the order to come to the market and then go in their favor.

Advantage: you will have a better Risk to Reward on that profile.

Disadvantages: Sometimes, the market doesn’t want to pull back and go in a straight line. But that all is part of the market.

The Difference Between A Pullback And A Reversal Trading

A pullback is temporary within the cycle, whereas reversals are changes in the process itself. A typical mistake that traders make is to pick the highest and the lowest shares, and they miss most of the general moves. We know staying with the trend can deliver the best possible output, but how to make it happen?

Data-driven analysis can help you achieve this. There is a narrow line between “pullback” & “reversal.” A pullback is temporary within the cycle, whereas reversals are changes of the cycle itself. So, if we can successfully differentiate between pullback and reversal, we can help our trades.

Reversal

A reversal is when the price trend of an asset changes direction. It means that the price can continue in that reversal direction for an extended period. These directional shifts can happen to the downside after an upward trend, or upward after a downside trend. There is a large shift in price. Yet, there may be pullbacks where the price reclaim the previous direction. It is impossible to tell instantly if a temporary price revision is a pullback or the continuation of the reversal. The change can be an instant shift or take days, weeks, or even years to arise.

Pullback

A pullback is a shift within a trend that doesn’t reverse the trend. Therefore, an uptrend reversal doesn’t appear until the price drops on the time frame the trader is watching. Reversals always start as potential pullbacks. The pullback is a short-term action opposite the longer-term trend, offering an opportunity to join an uptrend at a favorable price. A pullback says that the overall market trend has temporarily paused.

The Final Thoughts

If you are new, use pullback strategies that benefit you. Study and forecast future opportunities by calculating pullbacks. Observe how often pullback is occurring and make plans accordingly. Yet there will be some risk even after you have studied enough, so create a backup plan and combine two or more strategies to avoid losses.

Also, Gain Some Knowledge About, Why Do Traders Use Fibonacci.

The importance of Fibonacci trading lies in the fact that it can help you identify the exact places for some strategic transactions, or indicate where to place a target price or a stop loss. If you want to boil down modern trading to raw science, Fibonacci series is a good start.

The importance of Fibonacci trading lies in the fact that it can help you identify the exact places for some strategic transactions, or indicate where to place a target price or a stop loss. If you want to boil down modern trading to raw science, Fibonacci series is a good start. For starters, the MACD indicator is based on a relationship between two moving averages of prices – an average closing price of an instrument over a period of time that keeps moving one day at a time, hence the name ‘moving average’. If you factor in the importance of recent data and assign them more weight, you get an exponential moving average, or EMA. These moving averages are calculated for different periods, usually 12 and 26 days, and if you subtract the 26-day from the 12-day EMA, you get your MACD indicator.

For starters, the MACD indicator is based on a relationship between two moving averages of prices – an average closing price of an instrument over a period of time that keeps moving one day at a time, hence the name ‘moving average’. If you factor in the importance of recent data and assign them more weight, you get an exponential moving average, or EMA. These moving averages are calculated for different periods, usually 12 and 26 days, and if you subtract the 26-day from the 12-day EMA, you get your MACD indicator. Stochastic indicators work under the assumption that the closing price of an asset is linked to highest and lowest prices in the 5-day period (for the K line and 3-day period for the D line, see the second picture). Stochastic models can be used to estimate probability of an outcome when one or more variables are unknown. Statistically speaking, any outcome comes with a certain probability and this type of analysis is great for risk management.

Stochastic indicators work under the assumption that the closing price of an asset is linked to highest and lowest prices in the 5-day period (for the K line and 3-day period for the D line, see the second picture). Stochastic models can be used to estimate probability of an outcome when one or more variables are unknown. Statistically speaking, any outcome comes with a certain probability and this type of analysis is great for risk management.