It has become something of a stereotype for options to be associated with stocks – so much so, that people forget that Forex options even exist, let alone that they can also yield even more profit than regular options. A combination of Forex leverage and the risk management afforded by options are a potent mix. This would enable a trader to make huge deals with minimum exposure to their funds and assets. But in order to figure out how Forex options can make you rich, you need to know about their background and basic strategies.

Forex options

When talking about options on Forex markets, most of them are either call or put options. Call Forex option entitles you to acquire some currency at a (hopefully) favorable rate, while put option entitles you to sell off some currency at the above mentioned rate (they usually come in pairs). All terms and conditions are arranged in advance and the holder gets to decide whether to exercise his or her options, try to sell them (effectively closing out his positions, maybe even turning a profit in the process) or let them expire worthless, in which case the only loss is the premium which the holder had to pay in advance to the writer of the options. SPOT options are a relatively new addition to the market, but they seem to be even more obscure than traditional options (which is a shame, really, considering the versatility they bring, but I digress).

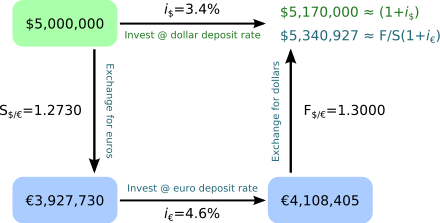

How Forex options work

Unlike regular options, Forex options involve a pair of currencies, so buying a call option on one currency automatically means a put option on the other currency and vice versa; an option to buy a few lots of, say, GBP/USD pair would be a “GBP call/USD put”. If the price shifts your way, you can exercise the options, exchanging dollars for pounds at a prearranged (favorable) rate and immediately sell the pounds at the spot price (which should be significantly higher). The difference should be more than enough to cover the costs, including the premium for the options. If not, you can always try to sell the options and cut the losses. In the worst case, you lose the entire premium, but that is all.

Making money

Forex options are most commonly used by Forex traders who anticipate major events or shifts, as a way to maximize the profit, but at the same time leave a viable exit strategy in case things go south. Furthermore, due to their nature, Forex options are often superior to cash positions assuming the amount of money is the same; plus, options give you more… well, options. It is a lot easier to sell your options than regular positions, even if you have to sell it back to the writer. Besides, Forex options can even double as a hedging tool, which can make success all but certain.