SMA or simple moving average in many ways differs from the weighted moving average. Being able to apply both under the right circumstances can mean all the difference between boom and bust. In order to achieve this, it is imperative to delve deeper into the nature of both technical analysis tools and discover how they work.

SMA or WMA: simple or otherwise

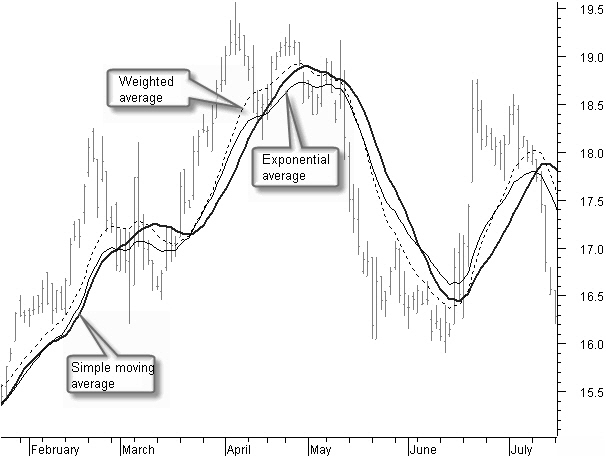

In a nutshell, the simple moving average, or SMA, is the average of all closing prices within the time period it refers to. You add all the closing values, divide it by the number of days and voila: SMA. The weighted moving average is similar, except later entries are given priority over the initial ones; they have more “weight” behind them. This is why the results of a technical analysis of a set of closing values achieved through simple moving average need not coincide with those of a weighted moving average (or exponential moving average for that matter). The time period and the set of closing values may be the same, but the results may vary due to weighted moving analysis being more biased towards recent data. All moving averages have the same purpose (to measure momentum) but they do so in different ways.

How does it work?

For example, let’s use both SMA and WMA to analyze a set of closing values for a currency pair over a five-day  period. EUR/JPY had closing values of, say, 150.090, 150.030, 150.000, 150.075 and 150.150, starting with the latest one. By adding them up we get 750.345; divide it by 5 and you get 150.069, which would be the SMA in this case. A WMA would allot, say, 15 points to all five entries, but distribute them so that the last entry gets 5 points, the previous gets 4 etc. The numbers would be: 750.045, 600.120, 450.000, 300.150 and 150.150; add up and you get 2,250.870; divide it by the number of points (15 in this case) and the WMA result would be 150,058.

period. EUR/JPY had closing values of, say, 150.090, 150.030, 150.000, 150.075 and 150.150, starting with the latest one. By adding them up we get 750.345; divide it by 5 and you get 150.069, which would be the SMA in this case. A WMA would allot, say, 15 points to all five entries, but distribute them so that the last entry gets 5 points, the previous gets 4 etc. The numbers would be: 750.045, 600.120, 450.000, 300.150 and 150.150; add up and you get 2,250.870; divide it by the number of points (15 in this case) and the WMA result would be 150,058.

What does this mean?

The results of SMA and WMA are off by 0.011. It may not seem like much, but even a discrepancy this minute could mean the difference between a downward and an upward trend, or at least a difference in momentum. It proves mathematically that SMA and WMA are not the same thing. By themselves, neither of them mean much, but in Forex markets, where fortunes are made and lost on a few pips, every single pip matters. And these are off by 11 pips. So, which one do you rely on? The worst part is that any of them could be off; heck, both of them, for all you know. Only time will tell. While Forex trading is not (quite) an exact science, if both SMA and WMA are rarely both wrong. This is why you should never rely on just one type of technical analysis. Try to diversify and play it safe, whenever you can.

An exhaustive study is available in the following link and the support team of your online broker can help you to understand it as well.