The Russian economy is heavily dependent on crude prices and the latest slump in the oil market means Russia’s recession might continue in the next year.

The first economic downturn since 2009 seemed to fade away as oil price increased 40 percent from a half year low in January. Crude oil price recovery has stalled recently, questioning the government’s infallibility on growth in 2016 and leading the budget to its largest deficit in half decades.

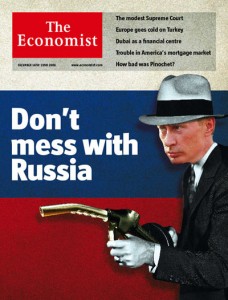

President of Russia Vladimir Putin assured the citizens that Russia is on the course of recovery, his optimism is much needed since in 2016 parliamentary elections will take place. According to ING Bank NV analysis the budget needs crude at $80 a barrel to balance its budget. The central bank says the Russian economy is strong enough to withstand two-year recession if the oil prices remain at $60 through 2016.

,“Russia will face a recession or stagnation next year” at $50 oil price levels explained in email Dmitry Polevoy, a Moscow-based economist at ING. “It will likely be necessary to cut spending more, to postpone a part of military spending and to use what remains in the Reserve Fund.”

Crumbling Ruble & Sanctions

Dazed from a currency crash in previous year and sanctions over Ukraine, the Russian government has already slashed budget expenditures by 10 percent and plunged into its sovereign wealth fund, the Reserve Fund, in order to help cushion the deficit. If the low oil price remain Russia may require additional financing from its other sovereign wealth fund, the National Wellbeing Fund, according to Polevoy.

The central bank already conducted a stress test which in its worst case scenario speculated with oil at $40 and an economic shrinkage of 7 percent. The central bank concluded that 187 lenders would face a capital shortfall of 0.6 trillion rubles ($11 billion) while the share of non-performing loans would double to 17.7 percent. If the oil at $40 is realistic the Russian economy would decrease for a third year in 2017, explained the central bank in June.

The latest government growth forecast visioned 2.3 percent in 2016 after predicting smaller contraction (from 3 percent fall to 2.8). Putin’s first two presidential term was an economic success story at least in terms of GDP growth: the average annual growth hit 7 percent in 2000-2008.

Russia and the Oil Factor

“The oil price shock may exacerbate the recession and/or prolong it,” explained Jane Muta chief analyst at HotForex broker. “Although we currently expect the economy to post very modest growth of 0.5 percent in 2016, we think the economy may remain in recession throughout next year if the average Brent oil price remains below $60.”

The Brent crude, used to price about half of the world’s oil including Russia’s blend Urals, lost 2.15 percent to $53.47 as of 16:54 p.m. in Moscow. It’s averaged about $59 this year.

The ruble, which plunged 46 percent against the dollar last year, strengthened to 59.69 against the U.S. currency. It’s one of worst performer in the past month.

Exit Postponed

The latest government draft for next year’s budget is based on $60 a barrel average Urals price, with an outline to cut the deficit to 2.4 percent of gross domestic product in 2016 from the 3.7 percent announced for 2015.

If the predicted price of $60 a barrel price is not likely and the crude trades average $55 a barrel in 2016, the Russian economy may stay in recession according to a report published on by OAO Sberbank, Russia’s largest bank.

“An exit from the recession is postponed until 2017,” Sberbank analysts led by Julia Tsepliaeva said in the report.