“What was I thinking?” is all too common a question for all those traders who do not know a first thing about successful forex trading tips, or have any basic understanding of forex psychology. Regardless of whether you employ good forex habits or bad forex habits, forex tips or forex tricks, what makes a successful trader is his or her trading skill. So, using psychology in forex and improving trading skills cam be just as important as avoiding forex mistakes. But enough about forex – let us talk about psychology, instead.

Introduction: A guide to successful forex trading

While psychology is not the main key for successful forex investing, it can certainly play an important part. We are not just talking about emotional psychology, but also about its cognitive aspects. Most traders believe that simply formulating a strategy and following it through would be enough to trade successfully, but this isn’t really the case – with any market, including forex. Even the finest strategy in the world will not be enough to save the trader from his or her own mistakes. Fear and greed come to mind, but there is an entire range of emotions that come into play here.

While trading based on emotions is going against most successful forex trading tips, it can also be detrimental to the trader’s mental health if they get emotionally involved in this whole trading experience. Furthermore, forex involves many different factors that need consideration. A trader’s attention is divided between several factors and the currencies they reflect on.

Their memory is put to the test, both short-term and long-term. Not to mention that the entire decision-making process is affecting the overall psyche of the trader, due to the strain it puts on the nerves, trying to detect and predict future trends etc. No trading strategy can effectively account for any of these aspects, so there is a lot of room for improvement in this regard.

Good Practice

Always keep in mind that forex trading is all about planning and preparation, while the execution itself only comprises a fraction of the total effort. This is why many successful forex tips deal with organizational skills and how to manage the risks that are involved, rather than how to predict future price movement or how to best execute your trades. Keeping things organized and planning every trade in advance is more than enough to prepare you for what is to come – even psychologically, if you plan for every eventuality.

Organization is the key to success.

Good forex habits also involve methods to hedge risks. For instance, the 1% rule – when you never risk more than you can afford to lose and try to limit each of your trades to 1% of your capital. That way, you can afford to make several mistakes before being forced to revise your strategy. The upside is that at least you will be in possession of enough information to locate the source of the problem. Aside from that, you can even combine forex with other forms of trading – use binary options as a hedging device, for instance. Any loss you make on forex can be covered by binary options and binary option losses will only diminish your profit from forex. Or you could look to successful forex traders for guidance, such as George Soros and his disciples.

Bad Habits

Perhaps one of the most important successful forex trading tips concerns avoiding all those bad forex habits, as well as suppressing any character traits that might affect your trading performance. Psychology cannot make your greed go away, but if you understand the mechanism behind it, you would be in a better position to resist its temptations. The same goes for fear.

Greed is one of your best allies, and your worst enemies when it comes to forex trading. While it could be a powerful driving force, if it gets out of control it will drive you over the cliff instead. As a reason why so many forex traders end up losing money, it trumps all other reasons – even fear. Statistically, greed is the most likely cause why you would enter a bad trade and the main reason why you would stay in instead of counting your losses and moving on.

Greed can be very bad.

Fear, on the other hand, is why you would hesitate to act and miss out on some of the opportunities in your life. It also makes for a poor advisor, as taking calculated risks is paramount for anything in life, and forex trading is no exception. This does not mean that you should whip yourself into a zealous frenzy, however, as trading mindlessly is not the answer, either. Instead, try to define your goals, the way to achieve them, find a way to manage the associated risks and just do it. If it works, rinse and repeat. Otherwise, cut your losses and try again later on.

A Couple of Tips and Tricks

We can talk about successful forex trading tips all day, but in the end it is best to find your own little ritual, for good luck. Or, if you do not believe in luck, you could try believing in psychology. It says this kind of routine will help you acclimate yourself and take some of the tension off. It does not have to be something that special, as long as it works – for you.

You could change your morning habits to include your favorite cup of coffee while watching forex news. Not only will it help you relax and informed about the current affairs, it will also help your mind associate forex with a pleasant, soothing experience instead of money-gobbling machine of death and destruction, or whatever your psyche will make of it.

Apart from that, you could probably search for other ways to assess the risks involved in your trades, which will also double as a great tool to understand forex markets. For your psyche, it will serve almost as a hobby, but it could also prove to be a great distraction that you may need in life. Alternatively, planning strategies may be more to your liking, as it would build up confidence as well as your forex skills.

The main point is not to employ all of these tips and tricks, or any other, unless they work for you. Remember, this is all about you and what helps you cope with the situations in your daily life. Since all people are unique, what works for you may not work for someone else, and vice versa.

The Biggest Mistake

Similar to how people are unique in their quest for the inner peace, the mistakes they are prone to are varied and happen all the time. Theoretically speaking, the biggest mistake you can ever make in forex is entering this world before you are ready, or knowing that you are not cut out for this kind of investment. Otherwise, the biggest mistake might be some sort of disastrous decision that ends up wiping out most or all of your financial assets and capital, but these are hard to make and easy to avoid. And yet, they still happen.

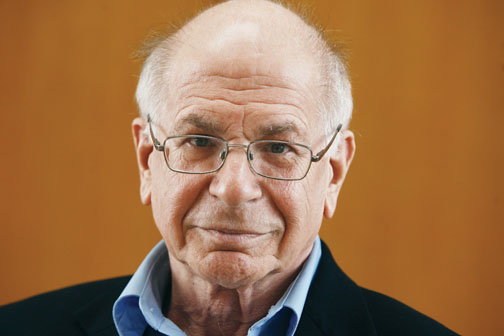

Why? Well, the answer to that question might be more difficult to obtain, although many have tried. In his book “Thinking, Fast and Slow,” Daniel Kahneman is elaborating on some of his research on how and why we make certain choices in our lives. In general, he has some interesting ideas such as his Prospect Theory that might directly apply on forex trades, but this may be far too advanced for you right now; even forex veterans are struggling to get to the bottom of that theory.

Daniel Kahneman

In any case, Kahneman is talking about two systems in which we form our thoughts: the first one is fast, emotional and subconscious – among other things – and the other is slow, objective and conscious. While not solving any of your forex-related problems, his ideas will certainly help you understand the background of your own decision making process and help you learn a thing or two about yourself in the process.

Conclusion

After everything, psychology in forex trading essentially comes down to controlling your own habits, ideas and above all else – decisions. By achieving a state where you are completely in control of your thoughts and actions, your career will have nowhere to go but up. The way you achieve it, however, must be your own – nobody knows you like you do. In any case, the key to your success is in your own hands, and its name is CONTROL.